Get in touch

Breeze Capital Launches Bridging Loans in Scotland

Breeze Capital is proud to announce the launch of its bridging loan range in Scotland, bringing our fast, flexible and straightforward funding solutions north of the border. Whether you’re buying a property at auction or dealing with a tight deadline, our bridging loans are designed to make this process as quick and simple as we can.

With many years of experience in structuring short-term finance and a reputation for quick decisions, Breeze Capital is now ready to support Scottish investors and buyers with the same high level of service we’ve become known for across the rest of the UK. If you need speed, clarity and a team that truly understands the value of acting fast, we’re here to help.

Bridging Loans in Scotland: A New Option from Breeze Capital

The demand for bridging loans in Scotland is on the rise, driven by an active property market and the need for fast, flexible funding solutions. Whether it’s for auction purchases, a development exit loan to buy you more time to sell a completed development, time-sensitive acquisitions, or short-term cash flow requirements, bridging finance is becoming a vital tool for investors and buyers across the country.

Scotland presents a few unique considerations when it comes to lending. Differences in the legal process, such as Scottish conveyancing practices and title registration, mean that lenders must have a clear understanding of how transactions are handled north of the border. Local knowledge is key, as is working with legal professionals and valuers who are familiar with the nuances of the Scottish system.

At Breeze Capital, we’ve taken the time to understand these differences and we’ve built a bridging loan product specifically designed for the Scottish market. Our entry into Scotland gives borrowers access to a new, responsive lender with a reputation for clarity, speed, and personal service. With direct access to decision makers, flexible structuring, and competitive rates, we’re here to offer a new level of support to Scottish borrowers who need short-term finance without the hassle.

Why Investors and Buyers in Scotland Need Fast Bridging Loans

In today’s fast-moving Scottish property market, opportunities don’t wait. Whether it’s securing a property at auction, bridging a gap between buying and selling, or acting quickly on a time-sensitive deal, having access to fast bridging finance can make the difference between winning or missing out.

One of the most common use cases in Scotland is auction purchases. These deals typically require a 10% deposit on the day and full completion within 28 days. Traditional mortgage finance simply isn’t fast enough. Bridging loans, however, can be arranged in days, giving buyers the confidence to bid decisively, knowing their funding is secured. We will even offer up to 95% of the purchase price making BMV purchases a potentially lucrative opportunity for Scottish buyers.

Chain breaks are another scenario where bridging finance proves essential. If a buyer in the chain pulls out unexpectedly, a bridging loan can provide the short-term funds needed to keep your purchase on track while waiting for a sale to complete. To be clear, whilst this is a standard bridging requirement, Breeze Capital does not offer regulated mortgage contracts, nor do we fund the purchase of residential property with a borrower who’s intention is to live in it.

The speed and certainty offered by bridging loans give Scottish investors and buyers a major advantage. Unlike traditional mortgages which can be slow, rigid and subject to last minute underwriting decisions, bridging loans offer flexible terms, streamlined applications and direct access to decision-makers. For anyone operating in a competitive or time-pressured environment, this level of agility is invaluable.

How Breeze Capital’s Bridging Loans Work for Scottish Property Buyers

At Breeze Capital, we’ve designed our bridging loans to be fast, flexible, and easy to understand, ideal for buyers in Scotland who need short-term finance without unnecessary complexity or delays.

Our typical loan-to-value (LTV) is up to 70% of the property’s open market value, depending on the strength of the case and security offered. We consider loan sizes from £50,000 to £500,000 (other higher loan sizes considered on a case by case basis) and we’re open to funding a wide range of residential and mixed-use property types across Scotland.

Interest rates start from 0.99% per month, and loans are typically arranged over terms of up to 12 months, with options to repay earlier without penalty. Whether you’re servicing the interest monthly or rolling it up to the end of the term, we keep our pricing and process clear from day one.

We pride ourselves on transparency and simplicity. No hidden charges, no confusing clauses or jargon, just straightforward lending with direct access to decision-makers who understand the urgency and pressure of closing property deals.

Real-world examples include:

- An investor in Aberdeen purchasing a tenanted flat from a motivated seller and needing fast funding to secure the deal before another buyer stepped in.

- A buyer in Glasgow using a bridging loan to complete on a new property investment because their funds are still tied up on another deal.

- A landlord in Dundee acquiring a buy-to-let property at auction and requiring funds within 10 working days.

These scenarios don’t require development or heavy refurbishment, just speed, certainty and a lender that gets things done. That’s exactly what Breeze Capital offers.

Bridging Loan Criteria in Scotland: What Breeze Capital Offers

At Breeze Capital, we keep our lending criteria straightforward and flexible, with a focus on the deal — not box-ticking. If the numbers make sense and the exit is clear, we’ll work hard to find a way to fund it.

Eligibility Requirements

We lend against a wide range of residential and mixed-use properties across Scotland, including houses, flats, HMOs, and standard buy-to-let stock. The security must be in a condition that holds market value, and we lend to limited companies, SPVs, and LLPs. We need to know in advance what the exit strategy will be but a professional borrower should be pretty certain of that anyway.

We consider properties throughout mainland Scotland, as well as key urban centres like Glasgow, Edinburgh, Dundee, Aberdeen, Perth, Dunfermline, Inverness, and surrounding regions. If you’re not sure if your location qualifies, just ask, we’ll give you a quick answer.

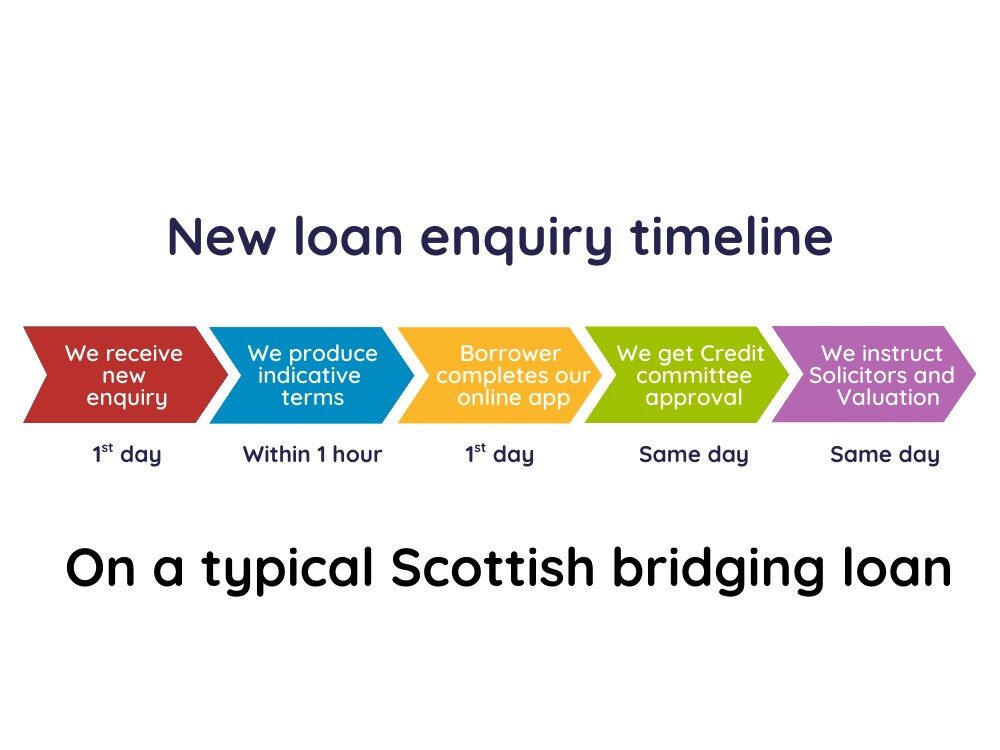

Application Process and Turnaround

We don’t believe in long-winded forms or unnecessary delays. Our application process is intentionally lean:

- Initial enquiry and Decision in Principle/heads of terms (usually same-day).

- Once we approve the case at Credit Committee, we issue credit backed terms

- Valuation and legal process initiated within 24–48 hours.

- Funds released, often within 7–10 working days, faster where needed.

Throughout the process, you deal directly with decision-makers — no middlemen, no layers of red tape.

Our Service Promise

We’re committed to giving clear, honest decisions quickly. If we can’t fund a deal, we’ll tell you upfront. If we can, we’ll move fast and communicate clearly from start to finish.

We use a risk-based pricing approach, meaning your rate is tailored to the strength of your case, not a fixed matrix. That allows us to reward stronger deals with sharper terms while still being flexible where needed.

Get a Bridging Loan in Scotland: Fast, Flexible, and Focused on You

When speed matters, so does who you choose to work with. At Breeze Capital, we specialise in fast decisions, tailored terms and giving you direct access to the people making the calls, no layers of bureaucracy, no chasing for answers.

We know every deal is different, which is why we take the time to understand the bigger picture. Whether you’re a property investor, homeowner, or broker, we’ll structure a solution that fits your exact needs quickly and clearly.

If you’re a borrower looking for short-term funding, or a broker with a deal to place, we’d love to hear from you. You can get an initial decision the same day, with full terms issued in hours not days.

Our team brings years of experience in bridging finance and a deep understanding of the Scottish legal process, valuation landscape, and regional market conditions. We don’t just lend in Scotland, we’ve done our homework to make sure we lend well.

For more information on how Breeze Capital can help you with your property requirements, please call us on 01244 565095

Follow us on our socials

Or click here to go to our main page: www.breezecapital.co.uk