Get in touch

What is the BRRRR strategy?

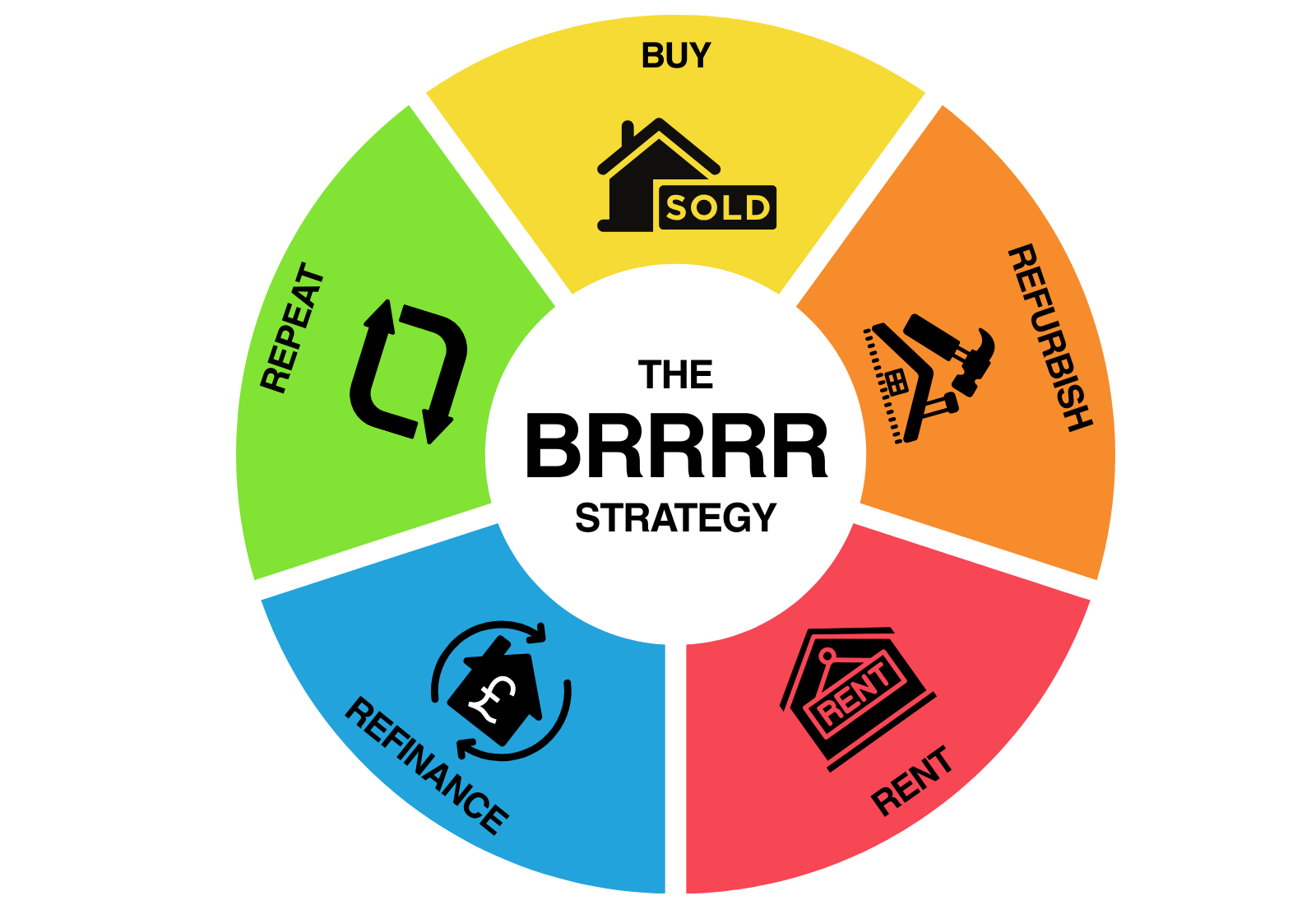

The BRRRR strategy has become a popular method for property investors aiming to grow their portfolio efficiently. It is a systematic approach that allows you to recycle your capital and build a portfolio of income-generating assets without needing to inject large sums of new money into each deal. The acronym BRRRR stands for:

- Buy

- Refurbish

- Rent

- Refinance

- Repeat

Understanding each step is key to successfully applying this powerful property development strategy.

Step 1: Buy

The first and most important step is to acquire a property at a price below its market value. The ideal target is a distressed or rundown property that requires significant refurbishment. This could be a property that is outdated, in poor condition or one found through a non-traditional sale channel, such as an auction. The goal is to purchase it at a price that leaves enough room to add value through renovations and still achieve a good return on investment.

Step 2: Refurbish

Once the property is purchased, the next step is to carry out the necessary refurbishments. This phase is about adding value to the property, not just making it habitable. Strategic improvements could include a new kitchen or bathroom, an extension or general cosmetic upgrades that will appeal to future tenants and increase the property’s overall value. Keeping a close eye on the budget and a clear scope of work is crucial to ensure costs do not run out of control.

Step 3: Rent

After the refurbishment is complete, the property is ready to be rented out to a tenant. This step is essential for two main reasons. Firstly, it proves that the property is a viable income-generating asset. Secondly, the rental income provides cash flow, which can be used to cover the mortgage and other running costs, making the investment sustainable. Finding reliable tenants and setting a competitive rent that aligns with the local market is key here.

Step 4: Refinance

With the property now refurbished and generating rental income, its value will have increased. This is the stage where you secure a new, long-term property finance arrangement, such as a buy-to-let mortgage, based on the property’s new, higher valuation. A key element of this step is using a “cash-out refinance,” where the new loan is for more than what you owe on the initial loan. This allows you to pull out a portion of the equity you have created, often recouping most or all of your original investment and refurbishment costs.

Step 5: Repeat

The final step is to use the capital you have just released from the refinance to repeat the entire process. The money that was tied up in your first project is now available to be used as the deposit for your next one. By continuously recycling your capital, you can acquire and improve a new property, slowly but surely building a portfolio of income-producing assets. This is the element of the BRRRR strategy that allows for sustainable and scalable growth in property investment.

For more information on how Breeze Capital can help you with your property requirements, please call us on 01244 565095

Follow us on our socials

Or click here to go to our main page: www.breezecapital.co.uk